HIPAA Sanity Checks for EDI Teams: 10 Controls to Validate Before Q1 Begins

If you work with EDI in a healthcare payer environment, the start of a new year brings a familiar cycle: reviewing controls, double-checking compliance, and asking if the organization is actually ready for the next HIPAA audit. With new compliance demands scheduled for 2026, from Security Rule updates to required documentation, it is more important than ever to run sanity checks that keep your eligibility and claims workflows secure and error-free. Here is a focused guide on 10 practical controls EDI and IT teams should confirm before Q1 begins—and why each item belongs on your checklist.

Why Early HIPAA Validation Builds Real Confidence

Audit stress is real. Regulations change, processes evolve, and the consequences of data mishandling—rejected files, regulatory fines, wasted IT cycles—never get lighter. By proactively confirming key controls, you set teams up to catch errors early, integrate smoothly with your claims system, and keep PHI secure in every EDI exchange.

1. Run a Full Risk Assessment on EDI Workflows

You need a clear understanding of everywhere PHI travels in your EDI environment. This means mapping out where 834 and 837 files land, the systems in play, and each human or third-party interaction point. Don’t just look for hackers. Think about internal mistakes, like files getting sent to the wrong trading partner or accidentally publishing PHI outside your claims platform. Document all this, along with a mitigation plan and proof of annual review. If you make major process changes, repeat your assessment. HIPAA requires you to retain records for six years.

2. Verify Multi-Factor Authentication Across All Access Points

Check that everyone accessing EDI pipelines (think SFTP servers, dashboards, claims portals) is using multifactor authentication, not just a password. If you manage eligibility or claims data, you want strong proof that only authorized staff are logging in—from the EDI coordinator to the enrollments director. Test logins by different team members to be sure permissions and protections line up with HIPAA expectations.

3. Confirm Encryption for Data in Transit and at Rest

Review your transmission paths to ensure that all PHI—whether being uploaded from a broker in CSV format or being sent to a claims clearinghouse—is encrypted using TLS protocols. At rest, files like 277 reports and 834 enrollments should be secured using robust encryption, like AES-256. Tools that automatically enforce encryption for all file formats (EDI, XML, CSV) make this check much easier. Review recent transfer logs to confirm nothing slipped through the cracks.

4. Review All Business Associate Agreements (BAAs)

Take the time to pull every BAA connecting you to external vendors, clearinghouses, and platforms. Confirm that each agreement is up to date, aligns with required breach reporting procedures, and spells out security standards and roles. If your data ever leaves the United States—even for temporary processing—make certain that the BAA addresses this and follows HIPAA guidance. Update any agreements that have lapsed or that do not cover your current risks.

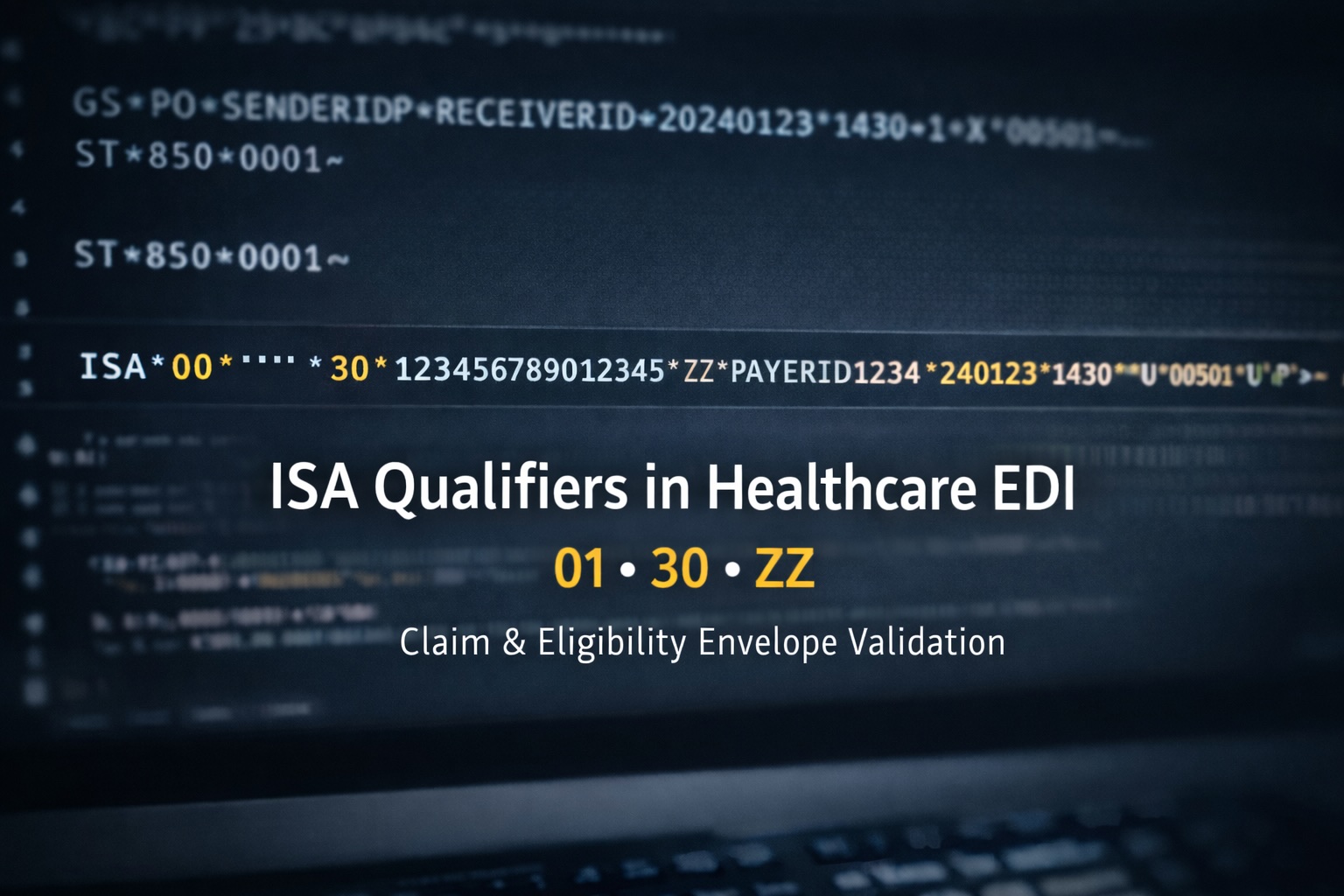

5. Test Structure and Standards Compliance

Even the best workflows falter if file structure and content break standards. You need to validate a sample of recent files, such as 837 claims and 834 enrollments, against HIPAA and X12 requirements. Pay attention to segment order, mandatory fields, and correct syntax. Automated platforms can handle this in bulk, but you should still spot-check, especially when formats or business rules change. Address all errors so claims and enrollments are not rejected downstream.

6. Scan for Vulnerabilities Every Six Months

Periodic vulnerability scans and penetration testing protect your environment from external exposure. Set a schedule to scan all servers and integrations at least twice per year. Watch for high-priority issues (for example, open ports or unpatched servlets processing PHI). Keep logs of what was found, fixed, and retested so you can demonstrate compliance in an audit. Even if your team uses third-party hosting, make sure the provider supplies scan evidence on your timeline.

7. Check Audit Logs and Monitoring in Real Time

Look at access records and audit trails for claims and eligibility transactions, ideally from the past month. This step lets you identify unusual patterns, repeat errors, or unauthorized access. Check that alerts are in place to flag processing discrepancies before they snowball. Role-based access controls should ensure, for example, that customer service teams only see the minimum PHI needed.

8. Validate Trading Partner Profiles and Enrollments

Outdated trading partner data can trigger file rejections. Review every TPID and NPI in your system to make sure enrollments are current, especially if any partners changed naming conventions or upgraded their technology. If CMS or carriers introduce new requirements in January, run tests to confirm files are accepted in their updated format. Small details, like correct file suffixes, deserve attention.

9. Conduct Functional Workflow Tests with Live Teams

Run simulated workflows that mimic real-world use. For example, process an eligibility (270/271) inquiry, submit an 837 claim, and push a 277 status back into your platform. Include staff from enrollments, claims, and IT to watch for process inconsistencies and missed steps. This practical testing gives you feedback beyond what an automated test suite will find.

10. Update Policies, Training, and Documentation

Regulations like the HIPAA Security Rule and 42 CFR Part 2 keep shifting. This means you should confirm designated privacy and security officers, review and update training for new threats, and ensure all breach response and PHI handling policies reflect the latest guidance. Test staff knowledge and keep records of completion. These requirements build a culture of trust across your organization.

Putting it All Together: Avoiding Sanity Check Pitfalls

Checking these controls is not just about passing audits. In our experience working with health, dental, and vision payers, organizations thrive when data is clean, systems are easy to monitor, and real-time transparency takes the guesswork out of compliance. Each control builds on the next, from technical hardening to staff readiness, so you can spot gaps before transactions get rejected or data leaks occur. If you need a deeper dive into challenges like solving integration pain points or the role of real-time audit trails, our team has written more on those topics as well.

By prioritizing these 10 controls every Q1, you set the tone for the year and reduce surprises. If you want guidance on automating portions of this checklist or making your EDI validation more efficient, you can reach out through our contact page.

.png)

.png)

.png)

.png)